Traditional banking houses no longer hold the monopoly on offering financial services. Instead, companies whose core business initially laid outside the financial sphere have adopted what’s called Embedded Finance. This means that they offer financial services as add-ons and parts of the regular user journey on their platforms.

Originally, financial services were embedded in online shopping or service platforms. Yet companies in other application areas adopt this practice, too. Thus, nowadays we arrive at a big list of different finance-embedding enterprises including:

- E-Tailers

- Online marketplaces

- Comparison portals

- BigTech companies

- Logistic and transportation firms

- Car manufacturers

- Social media giants

- And many more…

What all these diverse companies have in common is their aptitude for digitization. They already deliver on the tech front, mostly; the fin just has to follow. And even as most such companies only started to develop their financial service (or finserv) portfolio, they have vital advantages over competitors:

- A widely known branding that many customers are familiar with from their everyday purchases.

- A streamlined user journey, into which the financial services can be embedded easily.

- An affinity towards innovation and digital transformation – many of them have already shaken up their own areas of operation and are well known for it.

This mixture allows those new finserv players to quickly scale and activate a broad customer base when compared to cold-starting fintech companies.

But what is Embedded Finance exactly? And should banks or fintech companies care?

Examination underway…

What is Embedded Finance?

Embedded Finance is the practice of integrating any financial services or products into an originally non-financial environment. Companies from different industries embed finserv in the user journey, providing integration points for specialized financial enterprises to pledge their portfolios to a shared user base.

Embedded financial services must have financial institutions behind them. Payment service providers and e-wallet enterprises, but also banks and lending companies could be involved. And then “non-fin” businesses can always apply for payment, e-money and banking licences and offer such services completely in-house.

In any case, financial institutions handle in the background the actual financial services a user accepts, including processing, security and regulation. Thus, said user is as much a client of the financial institution as they are a customer of the platform offering it. This ultimately blurs the distinction between financial and commercial offers – between finserv and other service areas.

What Gets Embedded: The Basic Types of Embedded Finance

When companies embed finance, they usually choose features that correspond to their goods and services. The features address customers’ needs at specific points of the user journey. Take the following scenarios:

- Can’t want to pay for your smart car all at once? Just choose the option to pay it in instalments directly over the shopping platform – without interest.

- Need insurance for the trendy camera you added to the basket? The e-tailer will offer you one right away, provided by an insurer of note.

- Approaching the end of the month, but need that flight ticket right now? Just have the payment amount claimed in two weeks. (You might rightly identify this use case as Buy Now, Pay Later or BNPL…)

- Do you want to offer players customization options in your massively multiplayer online game, but do you also want to charge them for it? Integrate a virtual currency management system directly in the game’s UI.

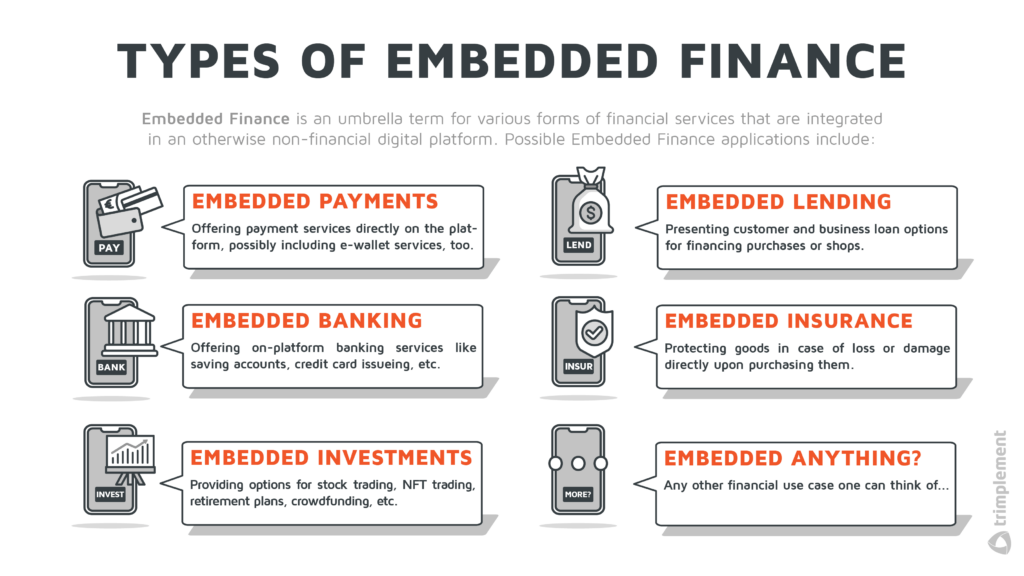

Just to list a few examples. Embedded Finance functions as an umbrella term various forms of financial services shelter under. We can name the following basic types of embedded finance:

Embedded Payments

Perhaps the most prevalent use case of Embedded Finance.

Companies with Embedded Payments offer payment services directly on their platform. It’s a common use case for any platform selling goods and services on the web. A BigTech company branching out in various fields and markets will probably consider launching its own payment solution, too. Or even settle for an electronic wallet system with balance management and payment options in line with their business. Just think of communication or mobility enterprises, like messengers (card-less payments with WeChat Pay i.e.), telco manufacturers or ridesharing companies (Lyft’s app conducting and receiving payment) as examples for modern Embedded Payment applications outside the e-commerce sphere.

Embedded Lending

In this use case, a non-financial company presents one or several loan options to “clients”, enabling them to buy or enjoy a service without disposable funds. “Client” is a varied term here: While some companies concentrate on deferred payments and loans to end-customers, marketplace platforms like Amazon often feature business loans to their merchants or suppliers as well.

In both cases, clients often appreciate the offerings: It presents them with immediate access to financial assets, sparing them the time-consuming dealings with external lenders. Commercial companies offering Embedded Lending may have an easy time assessing credit risks: After all, they know the spending habits and creditworthiness of their customers from their business connections with them.

What’s more, many commercial companies can keep interest rates lower than the competitors in the financial sector – especially for microcredits.

Embedded Banking

Just like Embedded Finance, we can understand Embedded Banking as a catch-all term that contains various banking services like saving accounts, transaction management or credit card issuing. Sometimes it’s used almost synonymously with Embedded Finance, as most financial transactions are backed by banking infrastructure. And where the non-financial company caters to a specific customer group, we could argue their Embedded Banking offerings represent a form of vertical banking.

Embedded Insurance

Insurance is often overlooked as a financial service, as it usually does not fall under the purview of banks and payment providers. Instead, insurance companies are the big players here – and insurtechs as their modern digital challengers.

For e-tailers and online marketplaces, insurance offerings are a natural fit: Customers may make expensive purchases and some will want those purchases to be protected in case of loss or damage – Amazon i.e. already offers insurance for products bought from the platform, while BMW provides car insurances for their customers. As with Embedded Payment and Banking, such offers have Insurers as service providers behind them, often connected via API – given that a company does not become a licensed insurance company itself.

Embedded Investments

This use case presents would-be investors with a shortcut to the stock markets. They no longer need to leave their favourite retail or social media platform to trade. In the latter case that’s very convenient, as they get the latest news and market influencer news delivered to the same platform.

But Embedded Investments are not only composed of stock trading. We can class mutual funds, retirement plans, crowdfunding – even trading with NFTs – among Embedded Investments.

Or Embedded Anything…

There is plenty of room for use cases not neatly fitting into the above categories. Our scenario of buying and trading valuable collectables in video games would stand as an example for such a more exotic use case.

The Advantages of Embedded Finance

Services like the ones above present clear advantages over the business models of traditional banks and insurers.

1. Customer-Centric Problem Solving

Financial services by non-financial companies must seamlessly fit into their product portfolio. That means they often gear towards specific problems occurring at a certain point during their customer journey.

In comparison, established pre-digitization institutions largely think among the lines of products and business processes. Even as they solve a real problem of customers, they often have to take the traditional sales routes. Most often that means throwing classic advertising to the wall and hoping that something sticks with customers. The persuasion skills of bank consultants come on top, as the second angle of attack.

Ultimately that boils down to hoping that a customer remembers the offer when they encounter a suitable problem. Embedded Finance takes the opposite path: The customers get reminded about a financial product or service through the context of it is presented in – and can apply for it right away.

With increasing sources for financial services, customers have become pickier. They don’t want to rely on one-size-fits-all solutions or pre-composed finserv packages. Rather, they prefer to mix and match products and providers as they see fit to their current needs.

2. Immediate Action

Though online banking has become a priority for many banking houses: E-commerce, online marketplace or telco companies have access to more optimized, digital and mobile channels. Online banking products already save us the trip to the branch office. But Embedded Finance providers go a step further and focus on immediate solutions that can be taken right where a customer stands – in the context where they would need them. Customers might not even need a traditional bank account. This presents a chance to provide financial services for unbanked and underbanked customers who otherwise would have no opportunity to take financial actions at all.

What’s true for location is also true for timing. Apps aren’t subject to opening hours – users can request financial services at any point. And if the Embedded Finance provider features it, the financial actions could even take place in real-time or consciously time-delayed (like “Buy Now, Pay Later”). That plays well into modern instant gratification expectations.

3. Data-Driven Approach

Today’s customers prefer products and services to match their personal needs, preferences and profiles. For web- and mobile-centric companies, the key to providing the right offer is data. And e-commerce, communication, tech and social media enterprises are in a unique position for easily compiling BigData. For example, an online marketplace can make conclusions about a customer based on what they buy. A search engine based on what they search. A fitness app based on where they go.

For customers, the outlook of being utterly transparent might be scary. If asked frankly, most people would want to keep control over their data – a wish that some governmental institutions try to meet with data protection laws like DSGVO.

However, data that is allowed to be collected, might be used to improve the customer’s experience in Embedded Finance environments. Machine learning algorithms can recommend finserv products that fit a customer’s financial situation perfectly. On a higher level, companies can even identify trends and demands, helping them to come up with new financial products.

4. Higher Customer Retention And Merchant Satisfaction

Embedding finance as a non-financial company is a tool to achieve a unified customer experience – on any platform, during any interaction. If a customer stays on the page instead of having to deal with an external provider, their financial actions become a part of the overall brand experience of an enterprise.

This in turn increases retention: Customers have the feeling they get help and are served well on-page, which is: By the brand. Thus, Embedded Finance can easily become a competitive edge.

That said, Embedded Finance will not only benefit end customers. If you run a B2B2C or B2B2B platform – like an online marketplace – your merchants and suppliers will appreciate payment guarantees, business credits or insurances offered directly on-site. And a well-operated “Buy Now, Pay Later” system won’t hurt them, either. It encourages customers to buy, after all.

In summary, all involved parties can profit from Embedded Finance: The provider, the end customer and the suppliers.

The Bottleneck: Why Embedded Finance Requires Partnerships

We note: Embedded Finance can boost revenue and sharpen a company’s competitive edge. So, why are you still here? Go get your Embedded Finance solution!

Well, not so fast.

Embedded Finance comes with challenges and can be hard to pull off, especially for companies that don’t have the technological infrastructure of Google or Tencent.

For customers, Embedded Finance reduces the complexity of interacting with payment, lending and insurance offers. However, that complexity still exists – it just hides behind scenes.

In the background, user interactions such as registration or contract formation have all the implications of services offered by full-fledged financial companies. Businesses must ensure certain security standards, adhere to AML, KYC and other financial regulations, verify and manage transactions, obtain the required licences and much else.

Thus, to not go the whole way and turn into a financial company in its own right – some do – companies form partnerships with financial institutions, insurers etc. They must also be able to overcome the technical hurdles that maintaining a finserv portfolio can cause. “No can do” without a reliable software infrastructure and partners with flexible APIs that can easily be integrated.

The Role of Financial Institutions

All but the most resourceful corporations need banking institutions as partners and third-party service providers to implement Embedded Finance. And it has become easy to fulfil that need: PSD2 and similar regulations further Open Banking. They press banks to provide customer data and APIs for licensed 3rd parties, so those can power their own financial services. Fintechs, banks and players in the new online economy are cooperating rather than competing now.

Or rather, some of them are. A significant number of banks view PSD2 as a regulatory necessity rather than a concession to the real dynamics of the digital market. They fear being marginalized when no longer maintaining direct relationships with their customers.

Those worries are not completely without substance: Their legacy systems often have nothing on the sleek, customer-centric solutions of modern e-commerce and tech players. That’s not to say that banks are not open to change that: Many found innovation departments, hire bright guys from the fintech area and update their product strategies. Yet, their technological preconditions and the regulatory environment where they are acting are still more immobile than those of the lean start-ups or the resourceful BigTechs that start to dominate the new payment economy.

Moreover, banks’ no longer surpass commercial companies in terms of customer trust. The “When Brands Become Banks” study by Solarisbank puts this in perspective: 61% of customers asked would be willing to use financial services provided by e-commerce companies. It should be noted though that the tech industry is also facing a decline in trust. That’s especially true for the BigTechs. And they are among the most active adopters of Embedded Finance.

Banking-as-a-Service: An Opening for Banks

Confronted with the rise of Open Banking and Embedded Finance products, some banks have found a way to stay relevant in the fast-paced, mobile-centric platform economy. The approach: Become a significant presence on the supplying side of Embedded Finance. Or, in other words, engage in what is called Banking-as-a-Service (BaaS).

Banking-as-a-service means offering banking processes and products, typically white-label or co-branded, to non-financial digital platforms, mostly via APIs. Banks largely operate the services then, while the partner company concentrates on their products and the user experience. Thus banks may reach new customer segments due to offering their products immediately and in attractive, goal-oriented environments.

The same applies to fintech software providers that offer the payment or e-wallet technology platforms required by non-financial companies. Like banks do with banking-as-a-service, such fintechs profit from a Software-as-a-Service (SaaS) business model.

The Bottom Line

Companies embracing Embedded Finance reach customer groups traditional banks, insurers and finserv providers are slowly losing their grip on. Those modern, digital financial players don’t sell products – they sell experiences. And that is the exact thing large, institutionalized banks struggle with today. As Angela Strange summarized it: “No one loves their bank.”

Thus, to stay relevant, banks ought to radically challenge their own self-image and business methods. For the future, that means many banks will accept the role of facilitator of Embedded Finance through Banking-as-a-Service – like Solarisbank and Goldman Sachs already do. That may not be enough in some cases though.

So, whatever banks do, they will not get out of introducing innovative solutions on eye-level with the tech giants. They might also arrange themselves within a comfortable niche in which it still can operate profitably: Vertical Banking is the watchword here.

In the meantime, the prospects for service providers supporting the Embedded Finance transformation will turn ever brighter. In 2020, Lightyear Capital estimated revenues from embedded financial products to become nine times as high in 2025 – reaching a total of $140,8 Billion. A fair share of this intake will go to fintech and software companies, which set up the necessary infrastructure.

And with (hopefully not more than) 2 years of COVID-19-induced lockdowns under our belt, the switch from brick-and-mortar to tech-and-monitor is already advancing more quickly than predicted.